Low-Power Wide-Area Technologies Continue to Drive IoT Market Growth

The growth and potential of Low-Power Wide-Area (LPWA) technologies. LPWA technologies are optimized for machine-type communications, supporting long-range connections with low power consumption and low data requirements. The article discusses the two categories of LPWA technologies, licensed and unlicensed, and predicts that LPWA connections will surpass traditional cellular connections by the mid-2020s. It explores the market growth, use cases, and deployment of LPWA technologies.

What does LPWA mean?

Low-Power Wide-Area (LPWA) is an umbrella term for a set of technologies that act in a way that is similar to traditional cellular services, i.e. supporting a long-range connection to a device. The difference is that LPWA technologies have been optimized to support machine-type communications: small amounts of data, generally sent infrequently, and where low latency is not a critical requirement. In so doing they can optimize for limited power consumption, allowing them to run for many years on a battery. They are also very cheap.

There are two distinct categories of LPWA technologies:

- Licensed Technologies: Developed as part of the 3GPP standards for mobile communications, i.e. developed by the mobile industry for deployment by traditional mobile network operators as an overlay or upgrade to existing networks. These include the NB-IoT and LTE-M standards and are referred to collectively as massive Machine Type Communications (mMTC) networks, specifically 5G mMTC.

- Unlicensed Technologies: Run in freely available spectrum in the same way that Wi-Fi does. That doesn’t mean that the spectrum can be used without limit. These technologies have to work within tightly defined parameters of power levels and frequency of messages in order to be permitted to use the spectrum. These technologies may be deployed privately to cover a campus or run by a service provider and in some cases even by mobile network operators who have chosen this path rather than NB-IoT. The most commonly deployed is LoRaWAN. Others include Sigfox, Wi-SUN, and Wi-Fi HaLow.

Transforma Insights has consistently emphasized the significant potential of Low-Power Wide-Area (LPWA) technologies. Since its inception in 2012, LPWA technologies have been recognized for their tremendous capabilities. In a recent blog post by Transforma Insights, it was projected that LPWA technologies would exceed regular cellular networks in terms of the number of connections by the mid-2020s. This article delves deeper into the factors driving this growth, providing insights into the historical and forecasted market expansion, the various applications of LPWA, and how these technologies will be deployed.

LPWA, or Low-Power Wide-Area, serves as an umbrella term encompassing a range of technologies that function similarly to traditional cellular services by enabling long-range connectivity for devices. However, LPWA technologies have been specifically optimized to cater to machine-type communications. These communications involve transmitting small amounts of data infrequently, with low latency not being a critical requirement. By prioritizing limited power consumption, LPWA technologies can operate on battery power for extended periods, making them highly cost-effective.

There are two distinct categories of LPWA technologies: licensed and unlicensed. Licensed technologies were developed as part of the 3GPP standards for mobile communications, designed for deployment by traditional mobile network operators as an overlay or upgrade to existing networks. Examples of licensed LPWA technologies include NB-IoT (Narrowband Internet of Things) and LTE-M (Long-Term Evolution for Machines), collectively referred to as massive Machine Type Communications (mMTC) networks, particularly in the context of 5G mMTC.

On the other hand, unlicensed LPWA technologies utilize freely available spectrum, similar to Wi-Fi. However, this does not imply unlimited use of the spectrum. These technologies must operate within strict parameters concerning power levels and message frequency to be authorized for spectrum usage. Unlicensed LPWA technologies can be deployed privately, such as on a campus, or operated by service providers and mobile network operators who have chosen this path instead of NB-IoT. Some commonly used unlicensed LPWA technologies include LoRaWAN, Sigfox, Wi-SUN, and Wi-Fi HaLow.

In terms of growth, LPWA technologies have shown remarkable progress when compared to traditional cellular networks. While cellular networks have been in existence since the 1980s and gradually evolved to support basic data services, it wasn’t until 2010 that the number of cellular-connected IoT devices worldwide exceeded 100 million. By 2020, this figure had skyrocketed to 1 billion. It is important to note that this count includes LPWA devices, such as NB-IoT and LTE-M, which slightly inflate the numbers. However, the significant surge in growth for LPWA technologies has occurred primarily in the past few years.

Comparing the growth trajectory of LPWA technologies with traditional cellular technologies, it is projected that LPWA technologies will experience exponential growth. Collectively, LPWA technologies are expected to increase from 698 million connections in 2022 to 5.24 billion connections in 2032. This surpasses the estimated 2.6 billion connections anticipated for more conventional cellular technologies like 2G, 3G, 4G, and 5G non-mMTC.

By the end of 2022, the number of connections under the 5G mMTC umbrella reached 434 million, with most of these deployments concentrated in China. In comparison, unlicensed LPWA technologies are projected to grow from 264 million connections to 1.7 billion connections. Over time, the mMTC share of LPWA technologies is expected to grow slightly from 62 percent in 2022 to 68 percent in 2032.

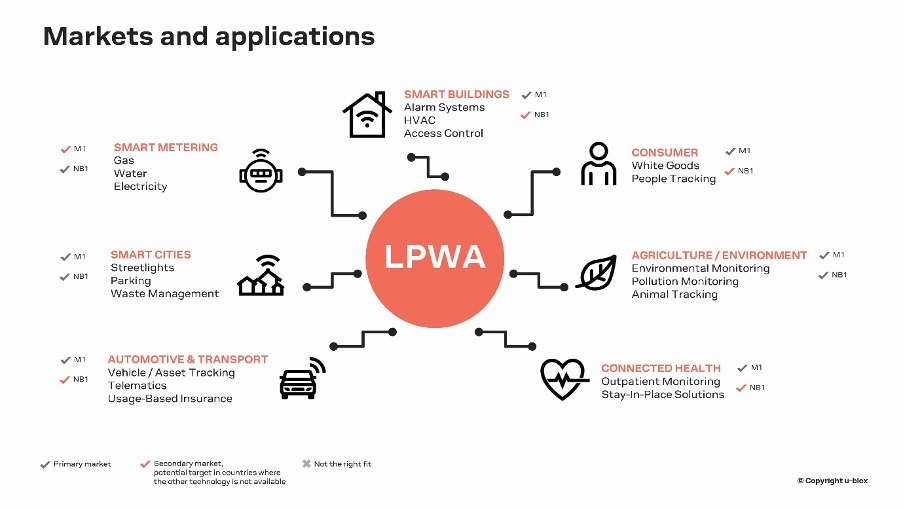

LPWA technologies find extensive application in various industries, with smart meters being a prominent use case. By the end of 2022, over half of LPWA connections (53 percent) were utilized for smart meters. However, there will be significant diversification in use cases over the next decade. By 2032, smart meters are predicted to represent 37 percent of total LPWA connections. This shift in market share can be attributed to the increasing deployment of LPWA technologies. Additionally, there is significant potential for LPWA deployment in existing applications. For example, NB-IoT-connected postal labels or Sigfox-connected direct marketing are expected to gain momentum in the future.

Post Curated and Written by: Anissh Babu